nevada estate and inheritance tax

NV does not have state inheritance tax. Ste 100 Las Vegas.

Synonyms For Death Tax Thesaurus Net

Over 5 Million Cases Posted.

. Nevada is among the majority of states that does not impose an inheritance tax. Legal Service Since 1999. Ad Keep A Parents Low Property Tax Base On An Inherited Property.

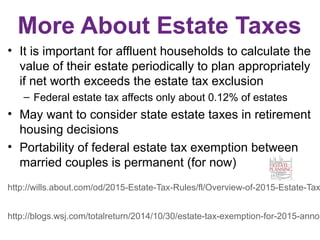

En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year. Describe Your Case Now. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. However it is subject to some exemptions. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. The state of Nevada does not collect inheritance tax however federal taxation may also affect an inherited property even in Nevada. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax Credit Nevada that was collected prior to January 1 2005. Federally speaking there is an estate tax but there are significant exemptions that currently exist. Anything more than 117mil can be taxed up to 40.

Since Nevada collects so much in gaming taxes they do not impose an inheritance tax or a gift tax. There are no estate or inheritance taxes in the state either. Fortunately Nevada does not impose an estate tax upon a decedents property.

For more information contact the Department at 775-684-2000. The top rate in 2020 was 15 percent but a reduction of 40 percent brings the top rate to 9. Beneficiaries of an estate will inherit the estate tax-free and they receive a step-up in basis that can allow them to sell those assets immediately without paying capital gains tax.

Federal estate tax The federal estate tax will be applied if your inheritance is more than 1158 million in 2020 though you will be. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the baseline rates until 2025 when the tax will be fully eliminated. Inheritances that fall below these exemption amounts arent subject to the tax.

The federal government no longer levies an inheritance tax either. The good news also is that the IRS does not impose an inheritance tax. This is a tax that is assessed when beneficiaries receive money from an estate.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. 4 hours agoLarissa Drohobyczer Esq. Sales tax is one area where Nevada could do better.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. In 2021 the first 117mil per individual is exempt at the federal level and therefore your estate will only pay tax if it is more than 117mil. Will once again offer the popular free seminar open to the public on August 16th from 530 PM -700 PM at Via Brasil located at 1225 S.

All of the kinds are checked by experts and fulfill state and federal requirements. Thorough estate planning will help you to reduce the taxable part and protect your heirs from a fiscal burden. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less.

Even though the beneficiaries may escape paying taxes to the state of Nevada they need to remember that they still have an obligation to pay federal estate taxes to the IRS. Since the state does not impose an estate or inheritance tax upon death less money is deducted during probate than if the property was located in any other state in America. Thats why Nevada is such a tax friendly state.

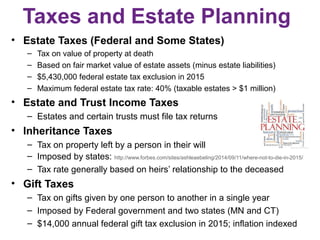

Whereas the inheritance tax is calculated separately for each individual beneficiary and the beneficiary is responsible for paying the tax. Ad Get Access to the Largest Online Library of Legal Forms for Any State. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Ad Review Attorney Profiles Ratings Cost Then Choose. We can help you keep a parents low property tax base on an inherited property.

The state imposes a 685 tax and counties may tack on up to 153 more. The federal estate tax applies to properties worth over ten million dollars but due to inflation it is. The event will cover the most costly mistakes made in most estate plans probate- what it is and why.

Try it for free and have your custom legal documents ready in only a few minutes. There is no federal inheritance tax but there is a federal estate tax. However an estate in Nevada is still subject to federal inheritance tax.

Federal estate tax The federal estate tax will be applied if your inheritance is more than 1158 million in 2020 though you will be. Ad From Fisher Investments 40 years managing money and helping thousands of families. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

The services provides thousands of web templates like the Nevada Estate and Inheritance Tax Return Engagement Letter - 706 which can be used for organization and private requires. The federal Estate Tax has a progressive rate that starts at 18 and can reach up to 40 significantly decreasing your inheritance. The District of Columbia moved in the.

When it comes to estate tax there is a federal tax to be paid. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax. An estate that exceeds the Federal Estate Tax Exemption of 1206 million becomes subject to taxation.

Why You Need A Prenuptial Agreement Prenuptial Agreement Divorce Lawyers Prenuptial

Quotes About Estate Taxes 29 Quotes

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

Quotes About Estate Taxes 29 Quotes

Quotes About Estate Taxes 29 Quotes

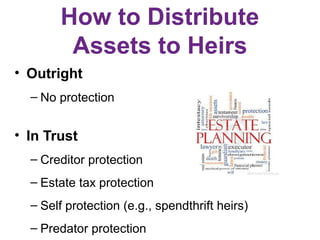

Estate Planning Basics Advanced Directives

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Market Inheritance Tax Retirement Strategies Tax

Estate Planning Basics Advanced Directives

Estate Planning Basics Advanced Directives

Utah Estate Inheritance Tax How To Legally Avoid

The Key Estate Planning Developments Of 2021 Wealth Management

Quotes About Estate Taxes 29 Quotes

Oregon Inheritance Laws What You Should Know